Saving money is difficult. It is very difficult indeed. No matter how prepared you are, you always have nothing but a few dollars in your account at the end of the month, right? A large portion of your salary probably goes into rent, and then there are the bills and expenses that consume your precious money without you realizing it. Then a voice comes. That tiny, giggling voice in the back of your mind says, “Why bother? You’ll never have the money to buy a house anyway. Then I’ll pamper myself with a fancy meal from that famous restaurant. I deserve it.”

Take a look at Kakeibo, the latest Japanese lifestyle trend. Kakeibo was invented in 1904 by Hani Motoko, Japan’s first female journalist, and was designed to help busy women control their finances. Fumiko Chiba has compiled this method as a guidebook under the title “Kakeibo: The Japanese Art of Saving Money”.

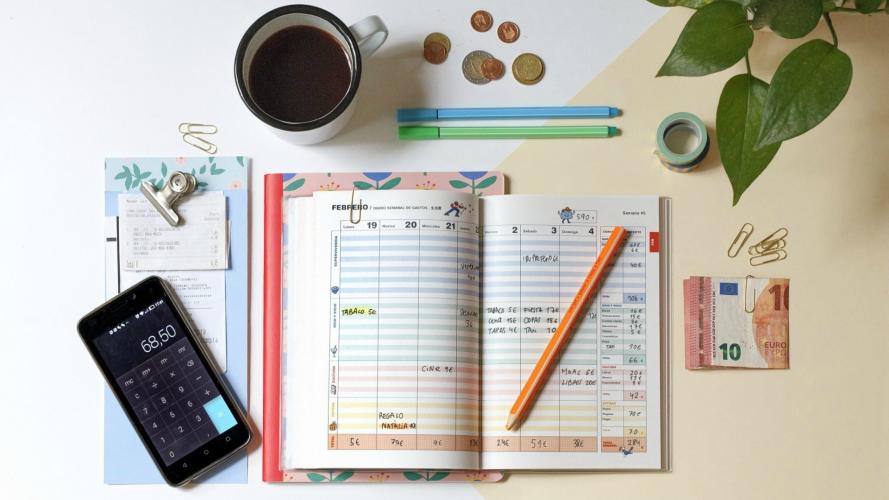

Here’s the concept: At the beginning of each month you sit in front of your Kakeibo and plan what to spend, what to save, and what you need to do to reach your goals. You then review what you have accomplished. Does it look simple? It really is! Here’s what you need to know:

1) We need to shift our focus from saving to spending

Author Chiba explains that we need to reshape our stance on budgeting; To “save well” we must “spend well” and vice versa.

Chiba, “Living and enjoying things “It’s important to remember this fact when saving money.” In other words, if saving is all about what we can’t and can’t have, it’s going to be a chore and we’ll probably just let it go. If you’re meticulously budgeting to be able to do and get what we really want, It becomes a much more inviting prospect if it becomes about doing it.

2) Writing things down will help

Keeping a Kakeibo is all about recording your expenses. But adding numbers to a spreadsheet isn’t enough. Engaging the paper and pen is an essential part of the application. “Most of our lives are spent on our phones or computer screens,” says author Chiba. “Logging our finances on things online instantly mimics the way we spend money. Writing on paper frees us from that imitation and gives us the space and time to look at our spending in detail.”

In this sense, Chiba says, using Kakeibo has become a kind of mindfulness exercise. “Our world is so fast now that everything can be bought and paid for very quickly. Kakeibo helps us slow down and think calmly and measuredly about what we’re buying.

“So at the beginning of the month, you need to figure out and write down how much money you actually have. From your paycheck to a $20 birthday present from your mom, look at what you have and add up all. Then your “fixed expenses” i.e. the things you have to pay like rent and utility bills. add them together and subtract from your total. Easy enough. This will leave you with an amount you can choose to “save” or “spend well”. This number may even be in the single digits right now, but don’t worry, we’re just getting started.

3) You need to be honest about your “obligations” and “wants”

Using kakeibo is all about getting your finances in order. If you have completed the step above you know how much money is coming in and you know what has to go out. Then now is the time to figure out how to spend the rest and find ways to do it better. Kakeibo works by categorizing your spending, making it really specific. For example, a category might be takeout food and beverages.

The items listed here can range from the pizza you want out to or a quick coffee to take away. Be meticulous. Once you know where your money is going, you can separate your “needs” from your “wants”: what you absolutely need and what you can survive without. Of course, we all need to eat; It’s a “must have”. But let’s be honest! Clothes are also a “must” but is it really worth spending all your leftover money on a famous brand?

By looking at your expenses in bits and pieces, you can identify areas where you can reduce spending, rather than a never-ending, guilt-ridden list of expenses.

4) Cash is better than card

These days, we keep a lot of cards in our purse instead of cash. According to Chiba, this could be a big mistake. We don’t feel like spending money when using cards. But paying cash in physical form can make us think twice about unnecessary spending.

Chiba even suggests withdrawing cash from the bank and breaking it into labeled envelopes to help you stay within your limits. “I think putting money in envelopes makes you less likely to spend it on other things like drinking with friends,” she explains. “Small actions can make a big difference in your savings goals. Acting with patience and consistency is what Kakeibo encourages.”

5) You must finish the month by reflecting on your progress

Just one glance at your mobile banking app is not enough. Your Kakeibo wants more! At the end of each month, your Kakeibo prompts you to review your past four weeks of spending, acknowledge your successes and weaknesses, and set goals for the next month.

Chiba says tracking spending in apps shows us where we’re going wrong. But you can get a wider perspective by using a Kakeibo. “I enjoy collecting small amounts each month. Although it may seem like a very small amount at the moment, it eventually comes together to create a huge savings. ” he explains. “Your review time continues to remind you of this progress.”

So get yourself a Kakeibo, doodle, and don’t forget to congratulate yourself after a month well spent.